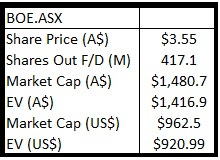

**Please note this was written and completed just before Reuters announced a report that US President Donald Trump will sign executive orders aimed to jumpstart the US nuclear industry by easing the regulatory process for new reactor approvals and enhancing the fuel supply chain. Boss Energy closed on Friday, May 23rd at A$3.98 (+12.11%) vs. the previous close A$3.55/sh in our note. Please be conscious of this when you get the ‘NAV generation’ section as alters the upside scenario.**

Boss Energy’s flagship uranium project is the Honeymoon Project located in South Australia, about 50 miles northwest of the town Broken Hill. The company utilizes in-situ recovery (ISR) as its mining method. In this Deep Dive we will cover:

History of the Honeymoon Project

Boss Acquires Honeymoon

Growth Story

Honeymoon Operations

Alta Mesa Operations

Financial Snapshot

Uranium Marketing Strategy

NAV Generation

Final Thoughts

History of the Honeymoon Project

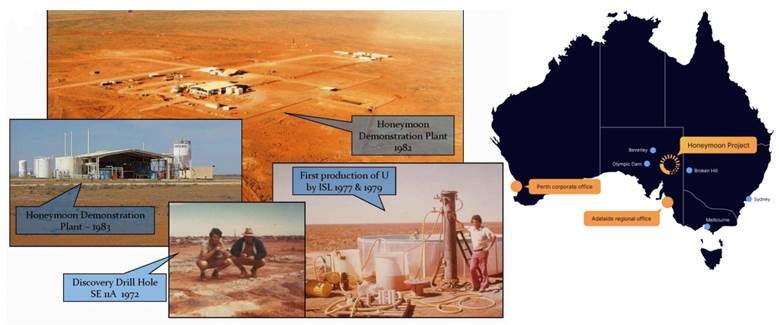

Exploration for tertiary sandstone uranium in the South Lake Frome Embayment commenced in the 1960s by Carpentaria Exploration, E.A. Rudd and Sedimentary Uranium. In the early 1970s, Mines Administration and Teton Exploration Drilling also began exploring in the area using the exploration philosophy that was utilized in the basins of Wyoming. Regional assessment identified potentially favorable buried fluviatile sands adjacent to uranium source rocks.

In 1970, Sedimentary discovered the East Kalkaroo deposit and the Yarramba deposit. By November 1972, the Minad Teton JV had discovered Honeymoon and by 1973, the Gould’s Dam deposit had been identified. Due to the size, grade, and configuration of the Honeymoon deposit, it was decided that ISR would be the best mining method to recover U3O8.

From 1975 to March 1983, the deposit underwent various drilling programs with an estimated 8.8M-lbs of U3O8 resource delineated by July 1979. By January 1980, the JV partners decided to build a demonstration plant and by May 1981, the Environmental Impact Statement (EIS) has been approved by State and Federal governments. As a result, the JV decided to move ahead with the construction of the demonstration plant. However, in November 1982, the South Australia state elections brought a change of government and in March 1983, the Three Mine Policy came into effect, restricting uranium mining in the country to three existing mines: Ranger, Nabarlek and Olympic Dam. From 1983 to 1986, the Australian Labor Party remained in power and as a result, the uranium industry could not advance any projects. It was not until 1996 and the abandonment of the Three Mines Policy were companies able to explore and develop uranium deposits.

Source: Boss Energy, Macquarie Conference Presentation, May 7, 2025

In 1996, Sedimentary Holdings, now a gold mining company, commissioned a study into its tenements and concluded that ISR-style mining at Kalkaroo was feasible and it made sense for these uranium interests to be combined. As a result, the consolidation of Honeymoon, Gould’s Dam and other tenements came under the ownership of South Cross Resources Australia. In May 1997, South Cross Resources took full ownership of the properties. Between 1999 and 2000, a series of leach trials were conducted and in May 2000, another EIS was produced by South Cross Resources.

In 2005, Southern Cross Resources was taken over by Aflease to form Uranium One, Inc. By 2008, Uranium One announced a joint venture with Mitsui to complete development of the project. By 2009, Russia’s ARMZ took a 51.4% stake in Uranium One. Commercial ISR-production began in 2011, with 45.4tU (~118K-lbs) of U3O8 produced in 2011. Just 37tU (~97K-lbs) was produced in the first quarter of 2012, but in May 2012, Mitsui announced that it was withdrawing from the project as It did not expect an economic return. Soon after, in November 2013, production was suspended by Uranium One (now a full subsidiary of Rosatom) and placed on care and maintenance due to ongoing production challenges, high operational costs and a softening uranium price environment following the Fukushima incident. Honeymoon produced 312tU (~811K-lbs) during this operational period.

Boss Acquires the Honeymoon Project

In December 2015, Boss Energy closed on the acquisition of the Honeymoon Project for A$9.6M from Uranium One with an 80% ownership stake. At the time, the Project included a total Mineral Resource of 16.57M-lbs U3O8. By January 2016, Boss delivered a substantial increase to the resource base to 27.6M-lbs of contained U3O8 at 0.82% or 8200 ppm uranium. Later that spring, Honeymoon released its maiden Mineral Resource Estimate (MRE) of 53M-lbs contained U3O8 including the Gould’s Dam deposit. A year later, in March 2017, the combined Honeymoon resource climbed again to 63.3M-lbs U3O8. In the fall of 2017, the company made a key revision to the Project, by removing the existing Solvent Extraction Plant and replacing it with an Ion Exchange (IX) Plant using NIMCIX columns. Additionally, the company successfully proved the performance of selected resins which showed significantly better results. In their 2021 Enhanced Feasibility Study, they discuss the numerous improvements made over the operation when Uranium One ran the project.

Source: Boss Energy, Enhanced Feasibility Study Results, June 2021, pg. 10

In March 2018, Boss increased its ownership of Honeymoon to 100% by acquiring the remaining 20% interest from Wattle Mining.

In February 2019, the MRE was upgraded to 71.1M-lbs U3O8. Within the Honeymoon restart area, the company held 36M-lbs and two months later, they announced that the Australian government renewed its export permit for 3.3M-lbs per year meaning the planned restart was fully permitted.

Over the course of 2021 and 2022, the company successfully raised A$185M, including A$60M to acquire 1.25M-lbs of U3O8 at US$30.15/lb which was heavily criticized by some in the market at the time. However, it was a strategic move, giving the company an asset on its balance sheet below replacement cost and giving confidence to utilities that they would ultimately move ahead with production. During this period, Boss released its Enhanced Feasibility Study, incorporating the NIMCIX Ion Exchange columns. The EFS confirmed a Life of Mine of 10+ years at a forecasted production rate of ~2.45M-lbs per year. Soon after, the front-end engineering studies were completed and in June 2022, the Final Investment Decision was made.

Growth Story

While the company has definitively and successfully restarted Honeymoon after optimizing the flowsheet and updating infrastructure and resins to suit its geology, there were many questions about the Project and whether it would succeed given Uranium One’s past struggles. Suffice it to say, we feel the company has buried any notion that the mine does not work or will face structural challenges moving forward as evidenced by its strong operational performance in recent quarters.

Today, Boss Energy owns Honeymoon outright (100%) and on February 26, 2024, they entered into an agreement with Encore Energy to acquire 30% of the Alta Mesa ISR Project in Texas, USA for US$60M including a US$10M investment into Encore shares. The formation of a joint venture company (70% Encore / 30% Boss) meant that Encore would retain operating control while Boss receiving 30% of the mine’s output. The total operating capacity at the Alta Mesa Central Processing Plant (CPP) is 1.5M-lbs of U3O8 per year. On October 8, 2024, Encore announced the opening of the Alta Mesa CPP with the first IX circuit commissioned in June 2024 with two more coming online in 2025.

Back in South Australia, Boss remains focused on expanding its satellite deposits, Gould’s Dam and Jasons looking to issue a Mineral Resource Update soon. Additionally, there is new exploration drilling on the Cummins Dam prospect area and continue to generate exploration targets around the licensed Honeymoon operation. Boss has also been awarded Kinloch Project exploration tenements ~80 miles south of Honeymoon and recently awarded three highly prospective tenements on the Eyre Peninsula in South Australia giving them a total package of over 6,000km2 in South Australia.

In the Northern Territory of Australia, which is a uranium friendly state, the company has entered into a stage-gated earn-in agreement with the Eclipse Group for the Liverpool Uranium Project in the highly prospective Alligator Rivers Uranium Field. The agreement provides Boss with an option, exercisable over a 12-month period, to earn up to 80% of the Project in return for Boss spending A$250,000 in expenditure during the option period. Upon exercising the option, Boss can earn-in up to an 80% interest by funding A$8M of exploration expenditure over a seven year period, split into two stages. Boss has a further option to purchase an additional 10% interest in the Project to 90% for A$50M upon completion of the earn-in arrangement.

Boss has also disclosed that it has purchased 48.1M shares in Laramide Resources (LAM.ASX) bringing its ownership in the company to 18.4% on an undiluted basis. Laramide’s flagship asset is the Westmoreland Uranium Project in Queensland, Australia. Westmoreland has a JORC Indicated Resource of 27.8Mt at an average grade of 770 ppm (0.71%) for 48.1M-lbs contained U3O8. The JORC Inferred Resource is ~11.8Mt at an average grade of 680 ppm (0.68%) for 17.7M-lbs contained U3O8. Boss says they are not currently in active discussions with Laramide and has no current intention to acquire control or make a takeover offer for the company. Boss CEO, Duncan Craib said, “This investment represents an attractive opportunity to secure exposure to the significant exploration and development upside at Westmoreland for a relatively small cost. While Queensland currently has a moratorium on uranium mining, we believe the state will enviably lift this. If the moratorium is overturned, Boss’ can apply its knowledge, experience, and financial strength to the Westmoreland project. This would be of significant benefit to the people of Queensland and all stakeholders.” (Boss Energy ASX Release, March 13, 2025).

Laramide also owns the Churchrock-Crownpoint uranium project in New Mexico, USA, La Sal Project, a conventional hard-rock asset in Utah, USA, and La Jara Mesa ISR Project in New Mexico, USA. Interestingly, they have a large greenfield uranium exploration opportunity in Kazakhstan featuring a 6,000 km2 land position in the Chu-Sarysu Basin.

Honeymoon Operations

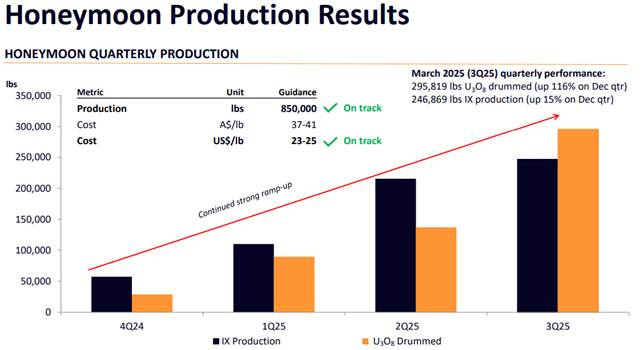

Boss continues to ramp up Honeymoon with FY 2025 production guidance of 850K-lbs, with IX production and drummed U3O8 improving on a quarterly basis.

Source: Boss Energy, Macquarie Conference Presentation, May 7, 2025

Drummed production for FY 2025 has been as follows:

Sept Q (FY Q1): 89,516-lbs

Dec Q (FY Q2): 137,084-lbs

Mar Q (FY Q3): 295,819-lbs

Total production for the FY tallies to 522,419-lbs. As a result, in the current quarter (FY Q4), they need to drum 327,581-lbs to hit guidance. Key infrastructure continues to be brought online including NIMCIX column 3, wellfield 3 and Kiln 2 was commissioned and became operational during the quarter . NIMCIX columns 1 and 2 continue to perform at nameplate capacity and as a result, we expect Honeymoon to hit production guidance (please note that we do not have any material non-public information). Additionally, during the current quarter, they expect to be able to increase the flow rate with availability of NIMCIX Column 3 and Wellfield B3, along with changing the precipitation circuit from batch to continuous operation.

Construction activities continued to advance during Q3 with the focus on steel frame erection, pipe spooling and assembly for NIMCIX Columns 4, 5 and 6. Construction activities should be completed by calendar mid-year, with the commissioning and production from NIMCIX Column 4 in Q1 FY 2026 (Q3 CY 2025). Their plan is to see NIMCIX Columns 5 and 6 operational in Q2 FY 2026 (Q4 CY 2025) which aligns with new wellfields being brought into production to increase flow and production rates.

Source: Boss Energy, March 2025 Quarterly Report, April 29, 2025

On the cost front, Honeymoon continues to track favorably against guidance last quarter, providing C1 cash cost guidance of A$37-$41/lb (US$23-25/lb) in the December quarter. Results came in better than anticipated (cash cost US$21/lb) as we can see below:

Source: Boss Energy, March 2025 Quarterly Report, April 29, 2025

Boss expects an increase in costs next quarter which will result in a C1 cash cost for the second-half 2025 at the bottom of the 2H’25 guidance range (A$37-41/lb, US$23-25/lb). Wellfield CAPEX of A$8M remains on track with 2H25 guidance of A$17-20M as progress and the cost per wellfield remain in line with expectations. The Capital Project expenditure, which includes most of the cost to complete Columns 4-6, remains in line with 2H25 guidance of A$19-21M.

To sum up, Honeymoon operations appear to be firing on all cylinders as the ramp up of wellfields and NIMCIX Columns continue. While other brownfield restarts have run into various hiccups, the detailed work that the team has put into place since re-working their Feasibility Studies has paid off handsomely. We look forward to seeing their continued progress on wellfield development and production rates.

Honeymoon Project Mineral Resource

Source: Source: Boss Energy, March 2025 Quarterly Report, April 29, 2025

Alta Mesa Operations

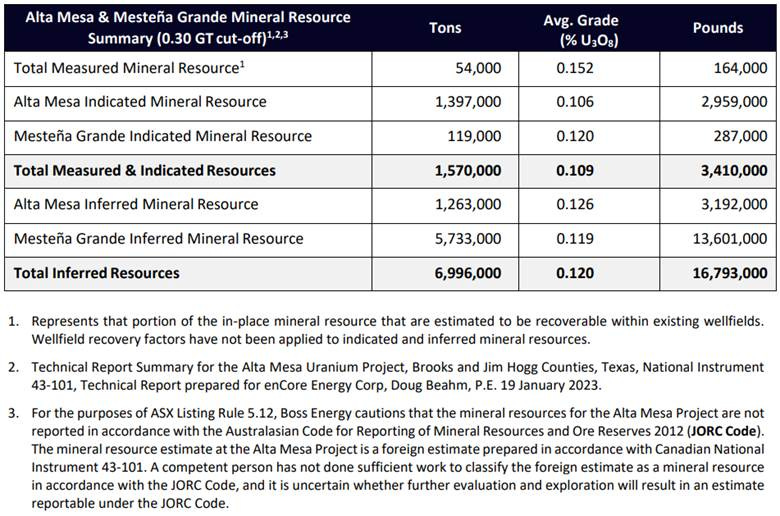

Alta Mesa production in Q1 2025 totaled 98K-lbs U3O8 on a 100%-basis. The average daily capture rate for the last 26 days of March 2025 was in excess of 1,900-lbs per day, representing the highest rate since the Alta Mesa plant returned to operations in June 2024. Boss received a total of 29,126-lbs U3O8 (their 30% share) delivered to their converter account. The ramp up of Alta Mesa to 1.5M-lbs was impacted by wellfield development but appears to have taken a number of steps to address the challenges. On March 12, 2025, they announced the successful startup of its second Ion Exchange (IX) circuit, doubling the total flow rate capacity. As processing capacity is expanding, they have installed additional injection and extraction wells. The combination of the second IX circuit and wellfield expansion utilizes ~75% of the current processing capacity. Encore says they will bring on additional wells to increase production toward their 1.5M-lb annual goal.

Alta Mesa Mineral Resource

Source: Source: Boss Energy, March 2025 Quarterly Report, April 29, 2025

Financial Snapshot

The company currently has total cash and liquid investments of A$229.2M. Unrestricted cash and cash equivalents stood at A$63.8M with a further A$165.4M in liquid investments including inventory at the end of FY Q3. This also included A$16.1M in a loan receivable from Encore which will be repaid during the current quarter.

During Q3 Boss received US$22.4M in cash related to a sale of 150K-lbs to a utility customer and the repayment of half of the uranium (100K-lbs) loaned to Encore, plus 18K-lbs interest at a rate of 9% per year on the 200K-lbs loaned to Encore. Below provides snapshot of their FY by quarter:

Source: Source: Boss Energy, March 2025 Quarterly Report, April 29, 2025

Uranium Marketing Strategy

The uranium marketing strategy is one of the most underrated and important aspects of how a mining company is run as this is where all the value is either created or destroyed. In our view, if a company does not have a contracting strategy, there is no point to even bring on uranium production. Selling solely to the spot market is a value destructive exercise as pounds will churn again and again until they are ultimately sold directly or indirectly to a utility. As a result, doesn’t it make more sense to simply…contract with a utility? We are extremely skeptical of any uranium company who says they want to maintain spot exposure by selling directly to the spot market. Please note that selling “market-related” contracts to maintain spot exposure is completely different than selling directly to spot. To learn more about term contract types and uranium pricing, please see Uranium Pricing 101.

On December 21, 2023, Boss announced they had secured their first binding sales contract with a US utility, for 1.0M-lbs with deliveries starting in 2025 with completion in 2031. The agreement was based on “market-related” pricing and contains a ceiling price and floor price which are above Boss’ total production costs at Honeymoon.

During their Q3 FY 2024, Boss announced its second binding contract agreement for the sale of 800K-lbs for delivery from 2024 to 2027 to a European utility. The agreement is primarily based on “market-referenced” pricing, subject to a ceiling price and a floor price.

We like to see Boss sign “market-related” contracts with floors and ceilings as it affirms management’s bullish view on the market and want to maintain exposure to higher prices via spot exposure, especially as their contracts extend to 2028 and 2031.

CEO Duncan Craib has reiterated their strategy, “Boss’ contracting strategy is to monitor the markets and layer in contracts, predominantly market-related for the uncommitted supply from Honeymoon and Alta Mesa, to optimize future pricing and, in the near term, to ensure profitability and cash flow as production ramps up.” (Q2 FY 2025 Activities Report, pg. 7).

As Honeymoon and Alta Mesa continue to ramp up, we feel Boss is well-positioned to take advantage of term pricing dynamics. We know that Cameco has reiterated its view seeking market-related contracts with floors and ceilings in the $70 to $130/lb range. While every company is different, Boss is only in the early stages of production and should be able to capitalize on limited global primary mining capacities now and into the future. We look for Boss to continue to layer in contracts giving them upside on their contract book.

NAV Generation

We have made the following key assumptions to generate the net asset value (NAV):

U3O8 Price: $100/lb

Discount Rate: 8%

Life of Mine: 21.81M-lbs over 11 years

Multiple to NAV: 1.25x

As we noted above in the “Uranium Marketing Strategy” section, we believe the company will continue to layer in market-related contracts with floors and ceilings. Given the window of when they will be able to layer in more contracts using the same contract types, we do not feel $100/lb prices are particularly aggressive given our forward view of supply and demand.

There will always be some debate about the discount rate used for mining projects. Given that their projects are in South Australia and Texas, USA, we feel 8% is a reasonable rate to utilize.

The NAV only uses the current EFS mine plan of 21.81M-lbs over 11 years with production peaking at 2.45M-lbs in FY 2027 through FY 2033. Given the organic and potential inorganic growth strategies, we are likely being too conservative since of the total MRE of 71.6M-lbs, only 35.7M-lbs are in the Honeymoon Restart Area.

This leaves 10.7M-lbs of inferred at Jason’s, with 6.3M-lbs of indicated and 18.7M-lbs of inferred at Gould’s Dam. As a result, this 35.7M-lbs is not included in the LoM but believe will ultimately be proved up and incorporated into the mine plan in the future. Nonetheless, we ascribe $4.00/lb on these 35.7M-lbs that currently sit in this category. Boss currently holds a valid Uranium Mineral Export Permission license for 3.3M-lbs per year so we expect the plant to ultimately work its way toward these levels in future years, which our NAV calculation does not account for.

Given the company’s exploration assets in the area, they believe the target holds in the range of 28Mt to 133Mt of mineralization at grades 340 ppm to 1080 ppm U3O8 for a contained 58M-lbs to 190M-lbs using a 250 ppm cut-off. We ascribe no value to these exploration assets.

As of this writing, we also give the company credit for the following assets:

Alta Mesa NPV Share (30%) to Boss: $100M

Cash: US$41M

U3O8 Inventory: US$86M

LAM.ASX Shares: US$23M

We recognize that some readers may balk at the 1.25x multiple to NAV but given the limited uranium mining capacities for the 2026-2035+ period, do we really think proven producers should trade at 0.8x or 1.0x NAV? We do not think so as these are premium and scarce assets in the world which deserve a premium multiple to NAV. Quite frankly, we feel many proven uranium producers will trade at even higher multiples than 1.25x. We are not saying this is an extremely conservative view, but a 1.0x NAV multiple is inappropriate given the limited future mining capacities.

When we put all the numbers into the hopper, we come out with a pre-tax NAV of A$4.81/sh or ~35% upside from today’s prices.

We recognize that you can effectively show whatever NAV you want for a project given the multitude of inputs and assumptions that one needs to make to complete this exercise. For us, this is about understanding the basics of the company, its assets and cost structure to derive a reasonable value as a head check against the market. Obviously, we need to be aware if costs blow out in the future or if we are undervaluing assets as we move down the road. These are moving targets based on the market and the operating environment.

Final Thoughts

We want to address two items that we have seen in regards to Boss Energy.

In Q2 2024, it was disclosed that CEO Duncan Craib, Chair Wyatt Buck and Director Bryn Jones sold stock representing 83%, 63% and 63% of their holdings respectively, excluding options. Our view? Job well done and superb sales. The stock was aggressively priced at the time as shares climbed north of A$5/sh. Like any other shareholder, management and directors have every right to sell shares, particularly if it is a relevant time to do so. We recall immense noise in the market around this event and it went on to absolutely punish the stock as it felt they were bailing the company or perhaps, the mine would not ramp up properly. Our view is to just let the market work. If it wants to sell shares down to unsustainably cheap levels like we saw in late 2024 or early 2025, it is the job of investors to take advantage of these dislocations, both on the upside and downside.

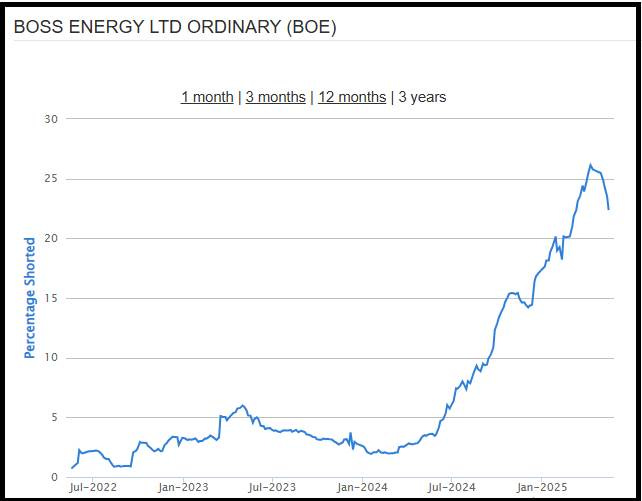

The second point we want to mention is the high short interest. As of Friday, May 16th, we see ~92.8M shares short or ~22% of the float. We have absolutely no idea what these short sellers are thinking here. From our vantage point in the world, it appears short sellers believe a few things:

Sentiment overhang from the 2024 share sales from the CEO and directors

Weakness in spot prices throughout 2024 and into 2025

Consensus bet that the mine ramp up would see production struggles and cost over-runs

The only other reason we can conjure up is that they believe(d) that uranium was about to be the next lithium (related to point two above) which shows an egregious lack of research from investors. The Chinese are full-steam ahead on supply growth as spodumene and brine are input costs to their higher value hydroxide or carbonate products. Uranium is the opposite of lithium today as we are in deficit and the supply response is slow, slow, slow. This compares to lithium which remains in oversupply and has numerous projects who continue to sell at a loss with even more latent supply waiting to come online!

Source: shortman.com.au

We do not understand the short interest, but this is ultimately their problem, not ours. Nonetheless, Boss Energy now has over 90M shares that will need to be covered in the future.

We hope you enjoyed our write-up on Boss Energy and we invite you to reach out with your feedback and comments.

Great report thankyou. I'm fingers crossed you do Paladin next!

Wow what a great and refreshing write up - well done sir! I wanted to ask a few questions about Boss as a rising dominant force in the Uranium Junior Space: (1) in your opinion is Alta Mesa (Encore) viewed by management as a resource uranium supply pressure spigot for access to pounds if there are local Australian production (unforeseeable calamities for example) where they can not be forced to the spot market with production shortfalls or could it be the early stages of an acquisition (because Encore has had a rough year on many fronts)? (2) which producers or near producers have the most savvy/savage uranium marketing strategy infrastructure and team members in place? (man I agree with your very well stated notation that this is a key part of the enterprise success going forward) (3) What properties have upside "nearology' to Boss over the next few years as potential acquisition targets because they have seemed like the corporate leader to me (4) Is Laramide more valuable for its Aussie holdings or the New Mexico assets? Thank you in advance for answering and thank you again for very valuable well written analysis