June 14th: Golden Rock Weekly Roundup

Market Update, World Bank, Diablo, Sizewell C, Aura, Nexgen Site Program

We are releasing our Weekly Roundup a day early this week as the plan is to camp out on the couch to watch the U.S. Open at Oakmont tomorrow. What a fabulous venue and test for the world’s best golfers. If you celebrate Father’s Day, please enjoy the day with your loved ones!

Market Update

The spot market was relatively quiet again this past week, inching lower to $69.75/lb to close the week. Sprott Physical Uranium Trust (SPUT) traded at a small premium to NAV on Friday and was able to issue 387.9k units for US$6.6M. This leaves their cash on the balance sheet at $36.2M. For investors with a long-bent, this was a welcome sight to see as the fund had not raised capital via its ATM in quite some time. Recall, investors did raise capital in a placement on May 12th which we covered here. We will see if SPUT decides to procure any pounds or wait it out for now.

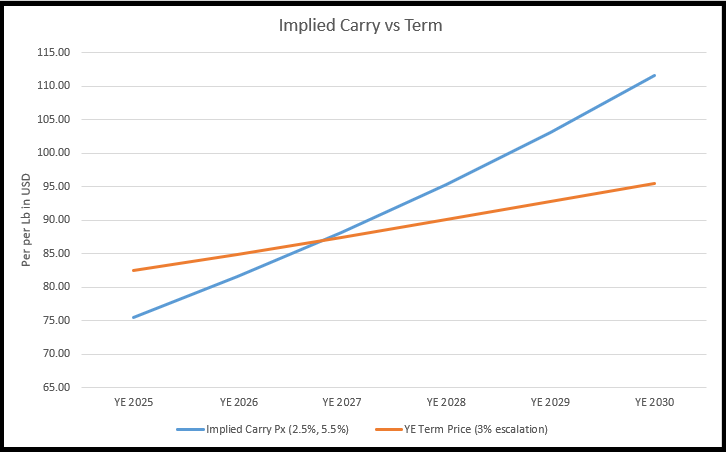

With the spot price backing up ~$2/lb over the past couple weeks, the carry trade window can be open for business. We use carrying costs (storage, insurance, trade fees) of 2.5% and financing costs of 5.5% per year. We will wait to see if any market participants decide to utilize it.

We continue to watch the ‘Russian Sanctions Bill’ (S.1241) in the United States and any potential impact to the market as well as more geopolitical uncertainty coming out of the Middle East.

Golden Rock Intraweek Commentary & Analysis

This past week, we released two posts so be sure to check them out if you have not already.

Westinghouse Targets $75B US Nuclear Expansion (Paid)

Flash Note: Talen/Amazon PPA Expansion + Market Update (Paid)

This coming week, we will be releasing ‘Deep Dive #8: Global Inventories Part 1’ so stay tuned! For those of you who have been following along with Golden Rock so far, you know we have been banging the drum that we are watching this market shift from an inventory to production-led market. As such, it certainly helps to understand who has inventories, how much and in what form? We recognize this analysis is tricky and some estimates must be made but welcome to uranium! This is just par for the course.

What else did we find interesting this week?

World Bank Ends Ban on Funding Nuclear Energy

On Tuesday, June 10th, the World Bank board met and changed its long-standing ban on providing funding for nuclear energy. President Ajay Banga set out the rationale for the change saying, “Electricity is a fundamental human right and the foundation of development. Jobs require electricity, as do health systems, education, clean water, public safety, and so much more. And demand will only grow as populations expand, economies industrialize, and digitalization accelerates.” We agree!

The goal is to give countries the flexibility to choose how to deliver the reliable energy needed to meet their development goals, especially as the developing world expects to see their electricity demand double by 2035.

President Banga went on to say, “For the first time in decades, the World Bank Group will begin to reenter the nuclear energy space. We will support efforts to extend the life of existing reactors in countries that already have them and help support grid upgrades and related infrastructure. We will also work to accelerate the potential of Small Modular Reactors so they can become a viable option for more countries over time.”

The last time the World Bank gave a loan for the new construction of a nuclear power plant was in 1959 for Italy’s first reactor, Garigliano which operated until 1982.

While we do not expect immediate loans to go out for new construction projects, this sends a message to the world that nuclear energy is being reembraced globally. We are hopeful that the World Bank begins to explore projects that can benefit from this funding.

California’s Diablo Canyon Can Operate for 20 More Years

In response to PG&E’s application to renew its operating licenses for 20 years, the Nuclear Regulatory Commission (NRC) reviewed inspections of Units 1 and 2 to evaluate how aging would impact various systems within the plant. According to the report, PG&E’s plans and procedures to address aging would meet the NRC’s safety requirements.

On November 7, 2023, PG&E applied for a 20-year license renewal to continue operating both units. If the NRC approves the license renewals, Units 1 and 2 will have the option to operate until 2044 and 2045 respectively with the California legislature’s approval.

Senate Bill 846 allowed the plant to continue running until 2030 and if PG&E is granted the two license renewals, the state must issue its own approval for the power plant to operate past that year. Diablo Canyon serves the vast state with nearly 10% of its electricity serving about four million customers.

UK Government Backs £14B Financing for Sizewell C

The UK government has committed £14B (US$19B) of capital to build the new Hinkley Point Sizewell C nuclear power plant. Chancellor Rachel Reeves said the “landmark decision” would “kickstart” economic growth creating 10,000 direct jobs and thousands more in firms who will need to supply the plant of critical parts and services. The plant, composed of two EPR-1750s would each have a net capacity of 1,630-MWs (3,260-MWs combined) capable of powering six million homes. The design would be similar to the two unit plant being built at Hinkley Point C in Somerset.

Prime Minister Starmer said, “Having our own energy in this country that we control, gives us security, gives us independence, so [Russian President Vladimir] Putin can’t put his boot on our throat. And it means that we can control the prices in a way that we haven’t been able to in recent years, which has meant very high prices for businesses, for households and for families.”

Source: EDF Energy

The UK’s goal is to grow nuclear energy capacity to 24-GW’s by 2050 via a mix of traditional large-scale power plants and SMRs. Today, the country only has nine nuclear reactor with ~5.9-GW’s of total net capacity which will consume ~2.3M-lbs of uranium per year. In order to achieve its goals, it will need to nearly quadruple its nuclear capacity.

Aura Energy Strengthens Executive Team

Aura Energy ($AEE.ASX) has appointed Philip Mitchell to Executive Chair from Non-Executive Chair to expand their options and efforts to secure project financing and for its 85%-owned Tiris Uranium Project in Mauritania. Philip has over 40 years experience in the mining industry including: Head of Business Development and Strategy at Rio Tinto, Chief Financial Officer at Rio Tinto Iron Ore, Member of the Executive Committee at Anglo American, and CFO of Robert Friedland’s led I-Pulse, Inc.

Tiris is fully permitted as the company works towards a Final Investment Decision this year with a Life of Mine plan of 25-years at 2M-lbs of production. Golden Rock currently models the mine to come online in 2028.

Nexgen Announces Regulatory Approval for 2025 Site Program

Nexgen Energy ($NXE) announced that the Saskatchewan Ministry of Environment has granted approval for their 2025 Site Program. The Program will include the establishment of a temporary exploration airstrip, expansion of the exploration accommodation camp by 373 beds and site access road improvements. Their plan is to commence these site works in the coming weeks to have the camp commissioned by Q1 2026.

We think Nexgen owns a tremendous development project with their Arrow deposit and are excited to watch how exploration efforts continue at Patterson Corridor East (PCE). However, after reading this press release, we wonder, did the company accidentally give away that their construction timeline for the mine that they publicly discuss (~4 years) is too aggressive? We truly respect what this management team has accomplished to date and the shareholder value creation since inception, but if it take 6-9 months to construct site works as a part of this Program, can they really build a mine and processing facility from scratch in four years? We have not spoken with management about this so perhaps our views are just wrong. Perhaps the timeline on this Program’s construction versus the mine/mill would be different given the number of employees at site. But, it does make us wonder.

We feel strongly that a big reason why utilities continue to move slowly on the term contracting front is that they have multiple developers over-promising production to the market. Given the structural supply deficits that exist today (Deep Dive #7: Q2 Supply/Demand Model) and every year into the foreseeable future, we are simply unsure why developers are so keen on discussing their speed to market. The uranium market isn’t a new tech advancement where there is a winner take all dynamic. At least, this is what we believe.

Thanks for reading and please have a wonderful week!

Enjoyed the roundup. Beyond your point on the possibly aggressive Rook I timelines compared to the site program estimates, I think it’ll also be worth watching whether construction wraps up on time and within budget. They’ve got a few good summer months ahead, but some tough winter ones near the projected completion. It’s a solid test for NXE management to prove they can deliver, even if this is one of the least complex phases...

Enjoy the US Open!