May 1, 2025

At Golden Rock, we categorically believe that the basis of understanding a commodity begins with primary supply analysis. This due diligence forms the foundation of our views and helps us understand how and where new supply-side events fit into the market.

We want to be extremely clear about how we feel about uranium, so you understand why we are starting with primary supply:

In many ways, uranium is one of the easiest commodities in the world to model, but because there are a preponderance of assumptions one needs to make to form realistic views, it gets messy in a hurry. If you’ve ever wondered why we see so many investors arguing over this niche commodity, it’s because every investor has a different level of knowledge about industry, the assets and a track record with operators to form a directionally realistic view. As a result, uranium supply analysis is part science and part art. We hope that our history in the industry will help readers increase their level of knowledge and as a result, the art to their supply analysis.

Today, there are only 17 countries that mine uranium or will be attempting to mine it in the future. Of these 17, the top five countries by production in 2024 (Kazakhstan, Canada, Namibia, Australia and Uzbekistan) accounted for a stunning 89% of total primary production. If we were to include the sixth spot, Russia, it takes that percentage to nearly 94%. Talk about concentration risk!

By 2030, we model the top five mining jurisdictions contributing ~85% to the total primary mining supply stack. By 2035, it will remain at 85% and by 2040, it marginally increases to ~86%. As you can see, this supply concentration isn’t going away. Nor will it. There are simply not an abundance of new, economic ore reserves in any country outside the top five with a legitimate permitting process that will allow this math to change.

Let us be clear: the investment thesis around uranium has been, currently is and will remain a supply led story until further notice. Simply put, there isn’t enough supply, and we don’t see a scenario anytime in the next 10+ years where there will be enough supply to meet reactor consumption, let alone cover an inventory re-stocking cycle by utilities, strategic inventory builds or financial entities who can come to the market at any time.

Don’t get us wrong, a market always needs a relevant amount of demand or consumption for the math to work. And we are seeing increasing demand in a variety of ways (uprates, life extensions, new builds, re-starts(!), policy U-turn, and underfeeding to overfeeding in the West) which we will explore another day. China is on a building spree. Just this week, they announced ten new reactor builds that will bring ~20M-lbs of U3O8 reactor consumption in the first year of operating (new load plus annual run rate). That’s real. That’s happening. So, demand is an important aspect of the nuclear market, but it’s supply that remains very fragile. The contract price of uranium will be driven by the supply capacity constraints that exist today and for years into the future. There simply is not enough capacity to account for what utilities will need to contract for.

Earlier, we talked about the science and art of the supply-side. The science is past and current production. We know what mines produced in the past. There is a plethora of industry resources one can use or manually go through public mining company reports. This is the easy part.

However, the future involves art, for both producing assets and developmental ones. This is where research becomes much more nuanced as one needs to lay out all the assets, their life-of-mine (LoM) plan, and understand if a mine plan is realistic. Can the LoM be extended by upgrading resources to reserves, does the economics make sense and if jurisdictionally, the mine plan can be extended past current licenses? As a result, one needs to go asset by asset and place a realistic lens on what each company is telling the market.

Given Kazakhstan’s enormous supply impact on the market, we feel it makes most sense to start here and focus on their production for 2024-2030. While we have built our supply model at Golden Rock through 2040, we want to focus on the nearby years as the market is attempting to determine what Kazatomprom’s plans are and its impact on the market.

Kazakhstan

It is well known that Kazatomprom (KAP), the 75% state-owned uranium miner in Kazakhstan, is the world’s largest producer of uranium, producing just over 1 billion pounds in its history. Starting in the early 2000s, the company switched to ISR (in-situ recovery) mining as its only uranium mining style as the country’s sandstone-hosted, low-grade deposits are well-suited for ISR.

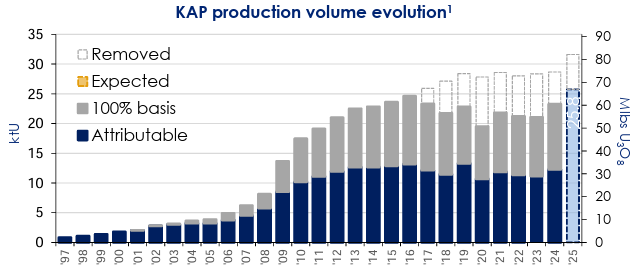

The management has adopted a “Value over Volume” approach since 2017 which meant they have voluntarily cut back total production. As readers likely know, the Fukushima disaster in March 2011 caused Japan to shut down all their nuclear reactors which was ~13% of global consumption at the time. A brutal and lengthy bear market ensued and Kazatomprom needed to reign in production as prices got so low, it even affected KAP, which dominates the Tier 1 cost curve. The chart below shows the prolific ramp up of production and their supply cutbacks starting in 2017. These cutbacks from 2017-2024 have reduced the total output by ~125 million pounds or ~15.5 million pounds per year. It simply didn’t make any sense for the company to continue growing production at cycle lows.

Please recall in 2017, the uranium market hit its cycle trough, with spot prices hitting $17.75/lb and long-term, base-escalated prices at $30.00/lb.

Source: Kazatomprom April Investor Handout, pg. 5

The company has 12 joint ventures that form the basis of its operations, including nine companies from five different countries.

· Canada: Cameco Corporation

· France: Orano

· Russia: Uranium One (Rosatom)

· China: CGN Mining & SNURDC (State Nuclear Uranium Resources Development Company)

· Japan: Sumitomo, Kansai Electric Power Company, Marubeni, Energy Asia Limited

Within the 12 JVs, there are a total of 14 mining units and 5 exploration projects.

Let’s break down the JVs so we have a better grasp of their operations.

Kazatomprom-SaUran LLP (100% KAP-owned)

This is a 100% owned subsidiary of Kazatomprom which currently mines from three deposits: Eastern Mynkuduk, Kanzughan and Central Moinkum. Two other deposits owned by the subsidiary, Uvanas and South Moinkum have been mined out. The operating capacity of the three mines is ~5.5M-lbs per year. Eastern Mynkuduk is expected to be depleted by 2028, Kanzughan is expected to be depleted by 2050, and Central Moinkum is expected to be depleted by 2040.

The three mines produced 2.8M-lbs of U3O8 in 2024.

RU-6 LLP (100% KAP-owned)

This is a 100% owned venture of Kazatomprom which currently comes from two deposits: Northern Karamurun and Southern Karamurun. The operating capacity of the two mines is ~2.5M-lbs per year and expect to be depleted by 2040.

The two mines produced 2.3M-lbs in 2024.

Inkai 3: (100% KAP, subsidiary of Kazatomprom-SaUran LLP)

Inkai 3 was also formerly apart of JV Inkai LLP and is located adjacent to Inkai 2. Like Inkai 2, the deposit was given up during a rearrangement of JV Inkai LLP in 2018 and is now 100% owned by KAP and is a subsidiary of Kazatomprom-SaUran LLP. It is also an advanced stage exploration project hosting ~220.0M-lbs at 0.057% U3O8. Last summer, KAP signed a new subsoil use agreement for pilot production.

We expect the mine to commence production in the early 2030s but do not expect it to reach its full stated annual capacity of ~10.5M-lbs until the middle or later part of next decade. It’s always a bit difficult to judge how quickly these projects can advance given the long time horizon but we continue to monitor any changes or announcements from the company.

Akdala (30% KAP / 70% Uranium One via JV SMCC, LLC)

The Akdala deposit is 70% owned by Uranium One (Rosatom) via the JV SMCC, LLC and 30% owned by Kazatomprom. The deposit has an operating capacity of ~2.6M-lbs and is expected to be depleted by 2027.

Akdala produced 2.2M-lbs in 2024.

South Inkai: (30% KAP /70% Uranium One via JV SMCC LLP)

The South Inkai deposit has the same ownership structure as Akdala. Production commenced in 2009 and has a projected LoM until 2060. It has an operating capacity of ~5.2M-lbs and produced 5.1M-lbs for 2024.

JV Inkai LLP (60% KAP / 40% Cameco)

Kazatomprom and Cameco set up this JV in 1995 and at present, Cameco holds a 40% interest with a current license until 2045. Starting on January 1, 2018, Cameco started accounting for JV Inkai on an equity basis which means Cameco accounts for its production share by purchasing the U3O8 at spot minus a 5% discount.

Inkai has experienced some operational issues, most notably shortages in sulfuric acid deliveries and some interruptions from reagent deliveries and wellfield drilling. Further complicating deliveries to Cameco, since the start of the Russia/Ukraine war in February 2022, Cameco doesn’t use any Russian rail or shipping lanes. Instead, they use the Trans-Caspian International Transport Route (TITR) which has led to some delays as this route has some logistical inefficiencies associated with it.

Somewhat bizarrely, on January 2, 2025, Cameco was informed by Kazatomprom and its controlling joint venture partner that as of January 1, 2025, JV Inkai had suspended production activity. On December 31, 2024, JV Inkai formally notified Cameco that it had not received an extension of the timeline to submit its updated Project for Uranium Deposit Development documentation, an extension that was expected prior to the 2024 year-end. Production resumed on January 23rd. This hiccup from Kazatomprom is a part of a longer string of events that is a cause for concern for us at Golden Rock. This topic goes beyond the scope of our writings today, but we will be addressing these concerns in the future.

An expansion of the Inkai circuit is currently in progress which includes upgrading the filtration and packaging units and the addition of a pre-dryer, calciner and automatic packing. The goal is to have this work completed sometime in 2026 and expects the deposit to increase production to 10.0M-10.5M-lbs.

The mine produced 7.8M-lbs in 2024.

Previously, we modeled JV Inkai to produce 9.1M-lbs for 2025, but on May 1st, during Cameco’s Q1 earnings call, we learned that guidance has been slashed to 8.3M-lbs, reducing our forecast by 800K-bs for the year. Further, CEO Tim Gitzel noted on the call, “JV Inkai’s production target for the year is not without risk.” Based on current guidance, Cameco should receive 3.7M-lbs this year but noted that deliveries will not be made until the back half of the year. Cameco held 11.2M-lbs in inventory at the end of Q1, so they have some cushion for Inkai deliveries. However, we do not believe they want to draw them down below 10M-lbs and could result in some spot market purchases to supplement any delay in Inkai pounds.

Inkai 2 (100% KAP)

This deposit was formerly apart of JV Inkai LLP but was given up by the JV in 2018 when some changes to the JV were made. Today, it is considered one of KAP’s most advanced exploration projects and hosts ~110.0M-lbs at 0.037% U3O8. Last summer, KAP signed an amendment to its subsoil use agreement which extends the exploration period to 2028. At present, there are no official development plans for the mine. As a result, we do not model any future production but are keenly watching any developments as we find it hard to believe they will never put it into production. However, it appears that production won’t occur before the early 2030s, at minimum.

JV Katco LLP (49% KAP / 51% Orano)

Kazatomprom and Orano set up this JV in 1997 and at present, Orano holds a 51% interest with KAP owning the remaining 49%. The JV holds two operating mines, Muyunkum and Tortkuduk. The operating capacity of the mines is ~10.5M-lbs

Like JV Inkai, the mines have experienced some operational difficulties due to sulfuric acid shortages in recent times. In the spring of 2024, the JV signed an amendment to the Subsoil Use Agreement which updated the production schedule to ~6.5M-lbs and expects a return to its “normal” production of about 10.0M-lbs by 2026 or 2027. However, it is not yet known if this return to normal production will be hit given the wellfield development work required at Tortkuduk.

Our best estimate is that the JV produced 5.8M-lbs in 2024.

JV Zarechnoye (49.98% KAP / 49.98% SNURDC China / 0.04% Kyrgyzstan government)

KAP and SNURDC Astana Mining Company (subsidiary of the State Nuclear Uranium Resources Development Corporation, Ltd.) each own 49.98% while the Kyrgyzstan government owns the remaining 0.04%. Up until December 17, 2024, Uranium One owned the 49.98% stake but sold it to SNURDC China. The expected LoM extends until 2028.

The Zarechnoye mine has an operating capacity of ~2.5M-lbs per year and production was 2.1M-lbs in 2024.

Appak LLP (65% KAP / 25% Sumitomo / 10% Kansai Power)

Appak LLP is a JV between KAP, Japan’s Sumitomo trading company, and Japan’s Kansai Electric Power Company that operate the Western Mynkuduk mine. The mine has an operating capacity of ~2.6M-lbs with the mine producing 2.3M-lb in 2024.

JV Akbastau JSC (50% KAP / 50% Uranium One)

This JV between KAP and Uranium One is comprised of three operating mines: Budenovskoye 1, 3, and 4 mines. The operating capacity of the three mines is ~5.0M-lbs. However, in November 2024, KAP announced an update to the Subsoil Use Agreement closer to ~5.7M-lbs. In 2024, production was 5.0M-lbs with the LoM expected to last until 2040.

Karatau LLP (50% KAP / 50% Uranium One)

Just like JV Akbastau, Karatau LLP is a 50/50 JV between KAP and Uranium One which operates the Budenovskoye 2 mine. It has an operating capacity of ~8.2M-lbs per year and the right to mine through 2040. In 2024, production was 7.9M-lbs per year.

Budenovskoye 5 (100% KAP)

Budenovskoye 5 is currently 100% owned by KAP and doesn’t have an operating mine. In the fall of 2024, KAP reported that it obtained its Subsoil Use License to explore for six years. KAP has reported that the deposit hosts ~45M-lbs of U3O8 although more work may increase the reserves. At present, there are no plans to mine as it is still in an exploration phase. As a result, we currently do not model any future production but will monitor any exploration updates from the company.

JV Budenovskoye LLP (51% KAP / 49% Uranium One)

This JV is composed of 51% KAP with 49% ownership from Uranium One and NFC Logistics Center, both of which are owned by Rosatom. The two Russian companies acquired Stepnogorsk Mining and Chemical Combine’s (SMCC) interest in the spring of 2023.

The Subsoil Use Agreement for the development of the project was awarded in 2020 with uranium production valid until 2045. The LoM plan allows for the development of its ongoing pilot plant with ramp up targeting a maximum annual production capacity of 15.6M-lbs no earlier than 2026.

However, the ramp up plans have not gone as planned. In summer 2024, changes to the Subsoil Use Agreement were made allowing for lower production targets. In this case, they were amended to ~1.2M-lbs for 2024 and ~3.2M-lbs for 2025.

It is difficult to understand exactly how production is advancing given some of the issues from sulfuric acid shortages. We currently model 2024 production at 2.0M-lbs and do not aggressively take this number up in future years. Unfortunately, we do not feel we have strong insight into production plans. As a result, we are conservatively modeling future production as we await new updates from KAP.

Please note that our understanding is that any production from this JV will ultimately be sold to Rosatom (Russia). Earlier in the piece, we noted that Russia is the sixth largest uranium producer in the world with some 6.5M-7.0M-lbs of domestic U3O8 per year. Given their own domestic fleet consumes 11-12M-lbs U3O8 per year (and rising) along with its VVER reactor export program, the Russians are in rather desperate need of new U3O8 sources. It appears that JV Budenovskoye will help satisfy this pressing concern.

We want to acknowledge that there is controversy surrounding this joint venture and deposit. On October 6, 2023, Energy Intelligence writer Grace Symes reported that there were mounting concerns “among knowledgeable industry sources that Kazatomprom will not be able to ramp up a new mine at the massive Budenovskoye 6 and 7 uranium deposit to the ambitious nameplate production goal of 6,000 tons uranium (15.6M-lbs)”. Further, the article goes on to say that the production license was only approved under pressure from the Kazakh and Russian oligarchs who sold a 49% stake in the project last year. At Golden Rock, we don’t have any proprietary insight into this development project. We continue to monitor developments at the project like everyone else.

JV Khorassan-U LLP (50% KAP / 30% Uranium One / Energy Asia Limited 20%)

JV Khorassan-U LLP is 50% owned by KAP, 30% Uranium One and 20% Energy Asia which is made up of a consortium of Japanese companies: 6% Marubeni, 6% TEPCO (Tokyo Electric Power Company), 4.5% Toshiba, 2.0% Chubu Electric Power Company, 1% Tohoku Electric Power Company and 0.5% Kyushu Electric. In December 2024, Uranium One announced it will sell its 30% interest in the JV to CGN Power. We will wait for the sale to close before switching over ownership to CGN Power. Once again, we are seeing that China continues to hunt down uranium pounds in mining projects.

The operating capacity of the mine, Khorassan 1, is ~6.7M-lbs and the JV can be mined until 2058. The mine produced 4.6M-lbs in 2024.

Baiken-U LLP (52.5% KAP / 47.5% Energy Asia Limited)

Baiken-U LLP is 52.5% owned by KAP with the remaining 47.5% by Energy Asia. Within the Energy Asia ownership, it is comprised of the same Japanese companies as JV Khorassan-U LLP but with the following stakes: 14.25% Marubeni, 14.25% TEPCO, 10.69% Toshiba, 4.75% Chubu Electric Power Company, 2.38% Tohoku Electric Power Company and 1.19% Kyushu Electric.

Baiken-U LLP has the right to mine through 2055 with an operating capacity of 5.2M-lbs, but the LoM is set to end in 2034. As a result, the JV will need to explore and prove up resources if it is to continue past the middle of next decade.

2024 production came in at 3.1M-lbs for the year.

Ortalyk LLP (51% KAP / 49% CGN Mining)

In 2021, CGN Mining acquired 49% ownership from Kazatomprom which operates two mines: Zhalpak and Central Mynkuduk. Given the close geographic proximity, it shouldn’t be a surprise that China continues to acquire stakes in Kazakh uranium mines.

Zhalpak is currently being ramped up (we estimate ~800K-lbs of pilot plant production in 2024) and we expect the mine to produce between 2.0M-2.5M-lbs per year once in a steady state. Central Mynkuduk produces ~4.2M-lbs per year and the LoM is expected to run through 2034.

In 2024, we modeled the two mines producing 5.0M-lbs.

Semizbai-U LLP (51% KAP / 49% CGN Mining)

Semizbai-U LLP is comprised of two mines: Irkol and Semizbai with KAP holding a 51% interest and CGN Mining with 49%. Irkol holds an operating capacity of ~2M-lbs per year and Semizbai’s operating capacity of ~1.3M-lbs per year. Irkol has a LoM plan until 2040 while Semizbai has a LoM through 2037.

In 2024, we model that Irkol and Semizbai produced 1.5M-lbs and 1.0M-lbs respectively.

Curveballs: COVID and Russia Invades Ukraine

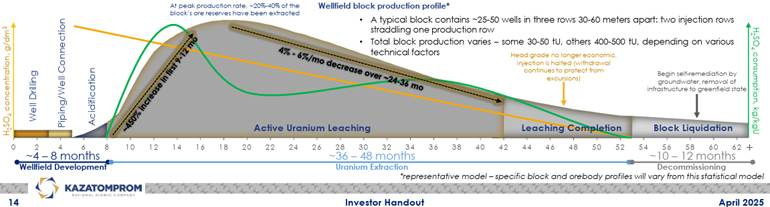

There is no question the last several years have been challenging in Kazakhstan for Kazatomprom and its JVs. COVID was a black swan event for the industry (and the world). Concerns of the health and safety of workers effected every mining company on the planet including in the ISR fields across Kazakhstan. Since Kazatomprom mines use only the ISR-method, COVID had unique impacts on its mines. The company does a nice job laying out the basics of how ISR mining works.

Source: Kazatomprom April 2025 Investor Handout, pg. 14

The first activity any ISR mine needs to complete is wellfield drilling for the injection and extraction wells. Then, the piping and well connections must be made to tie the wellfield together. Once complete, acidifying the wells can take several months as sulfuric acid usage ramps up along with initial production.

The issue with COVID is that every mine and mining block among the litany that they have were all in different places when COVID hit. As a result of the reduced headcount and ability to receive materials on-time (piping, regents, acid, etc.) caused production delays. During this time, new wellfields needed to be constructed and were delayed, some wellfields couldn’t be completed due to lack of materials and/or labor, and some wellfields that were ready to be acidified couldn’t. This chaotic environment led to production issues that were not any of the operator’s fault. As a result, this had a knock-on effect once Kazatomprom and JVs were able to return to a more normal environment. In some ways, the company is still feeling the effects from COVID as it tries to get back to intended guidance.

Just as the company was stabilizing from the effects of COVID, the world learned that Russia invaded Ukraine on February 24, 2022. This immediately sent shock waves through the uranium mining world and the impact waves would soon reach the mines in Kazakhstan. Due to Russian sanction risks, western JVs began exploring alternative shipping routes to avoid any Russian-based shipment lanes (both rail and ship). This put more pressure on an already crunched supply chain as the world was trying to normalize from COVID. Today, ~64% of western shipments utilize the TITR route.

Sulfuric Acid Shortages

In a series of headwinds, Kazatomprom began experiencing a sulfuric acid shortage impacting production in 2024 and appears it will be felt once again in 2025. The shortage was due to a combination of increased demand from the agricultural sector for fertilizer production and regional supply chain disruptions. Our understanding is that Russia’s production was reduced for a variety of reasons due to sanctions and the Ukraine war.

Kazatomprom discusses this in the slide below:

Source: Kazatomprom April 2025 Investor Handout, pg. 15

Kazatomprom has been and is actively seeking alternative sources and plans to build a new acid plant in the Turkestan region with an annual capacity of 800,000 tons which is expected to come online in the next couple of years. However, the market learned during Cameco’s Q1 earnings call, on May 1st, that construction of the new acid plant hasn’t begun. Like everyone else, we are waiting for updates on this front, but this means that sulfuric acid remains very tight and could continue to impact production rates.

Other Considerations Impacting Kazatomprom – FX Rate

While this piece is attempting to only focus on Kazakhstan’s supply, there are a couple of items we want to briefly touch on before we sum up 2024 production and give some data to 2030.

Over the past several years, Kazatomprom has benefited immensely from a falling Kazakh Tenge (KZT) vs. the US dollar. The reason is that Kazatomprom costs in KZT but sells their product in dollars. As a result, when the KZT is falling, it becomes cheaper to produce and get to recognize sales in an appreciating currency.

Since 2015, the USD/KZT rate has exploded higher from 185 to 515 today (when USD/KZT rises, the Tenge is falling in value). This has meant a massive tailwind to Kazatomprom costs.

However, in recent years due to inflation and other factors, the costs of production at Kazatomprom have not been dropping, but rather the opposite. While we will save our cost analysis for another day, the important takeaway is that the cost-curve for uranium production, even for the Tier 1 producer is quickly rising. This will help shape the market for years to come as Kazatomprom and their JVs will need to see higher prices to maintain margins.

Other Considerations Impacting Kazatomprom – MET Rate

On July 10, 2024, Kazatomprom announced that the Government of Kazakhstan introduced amendments to the tax code which included changes to the Mineral Extraction Tax (MET) rate for uranium. MET is incurred and paid for by the mining entities. For 2025, the applicable MET rate for uranium will change to 9% only for the year 2025.

Starting on January 1, 2026, a differentiated MET approach will be used depending on the actual volume of annual production under each Subsoil Use Agreement. The schedule will be as follows (Golden Rock inserted the pounds conversion):

Furthermore, they go on to state, if the natural uranium price exceeds the values specified in the table below, an additional MET rate increase will be applicable:

At the end of the day, it’s clear that the government of Kazakhstan is using this as a revenue generation opportunity which will effectively decrease the value that Kazatomprom and all JVs will receive on every pound produced. Furthermore, given the graduated tax rate as volumes increase, will JVs have more or less of an incentive to produce more? We argue less.

Adding It All Up and Estimates to 2030

In 2024, Kazatomprom produced 60.5M-lbs on a 100% basis. On an attributable basis, Kazatomprom produced 31.96M-lbs.

The latest guidance expects to have a mid-point production of 66.98M-lbs for 2025. Given the variety of challenges in the country, we believe that they will not be able to hit ~67M-lbs and our internal forecast is for 64.0M-lbs, a miss of ~3.0M-lbs. The lower end of their guidance is 65M-lbs. In the grand scheme of things, this is not massive miss given their scale, but this is just our view today. Given that things change, we do not feel that we have any material edge in guessing the exact levels of production for 2025. Rather, it is our best estimate of what we know today.

Source: Kazatomprom, Cameco, Golden Rock Research estimates

Our final comments on Kazakhstan production simply relate to where are these pounds going. It is very important to realize that China and Russia hold a lot of influence over the country as it is wedged between them. China has a vociferous appetite for uranium and continue to build stockpiles well in advance of their current needs. But we know that China has very little domestic supply which is why they continue to make investments in mines abroad while continuing to sign long-term contracts wherever they can, including for Kazatomprom-owned production.

Russia also doesn’t have robust domestic uranium production as we noted earlier in this piece. As a result, Rosatom continues to make investments in Kazakhstan as this is the lowest hanging fruit they can find to bolster their domestic usage and export reactor needs.

Meanwhile, Western utilities effectively remain asleep at the wheel believing that development projects in the West will come on time and on budget. We believe these views are woefully misguided.

We look forward to updating our Kazakh supply model as we get more information from them in the coming quarters!

Source: Kazatomprom, Cameco, Golden Rock Estimates

Great write up, curious why you haven't included the revised SUA starting 2027 for Karatau: 3,600 tU vs 3,200 tU & Akbastau: 2,194 tU vs 1,931 tU? You also don't believe they will come anywhere near their guidance for Bud6&7?

Thanks for the thorough write up